If you’re a high earner, odds are you might think that Roth investment strategies—and their enticing tax benefits—are simply out of reach. Think again! There are several creative Roth investment strategies high earners can leverage as they near and enter retirement.

Key Takeaways:

- High earners are traditionally prohibited from contributing directly to Roth accounts because of their income.

- If you have an employer-sponsored retirement plan that has Roth components, you can complete an in-plan conversion to a Roth 401(k).

- Mega backdoor Roth conversions are complicated, but if you meet all of the requirements it could be really effective.

- If you wait until you retire—and time the conversions well—you could build up a sizeable tax-free account for the duration of your retirement

Why Can’t I Contribute Directly to a Roth IRA?

Roth IRAs have income thresholds that limit or entirely prohibit high earners from making direct contributions.

2023 Roth IRA Contribution Limits

If your filing status is… | And your MAGI is… | Then you can contribute… |

married filing jointly or qualifying widow(er) | Less than $218,000 | up to the limit* |

married filing jointly or qualifying widow(er) | $218,000 – $227,999 | a reduced amount |

married filing jointly or qualifying widow(er) | $228,000 or more | zero |

married filing separately and you lived with your spouse at any time during the year | less than $10,000 | a reduced amount |

married filing separately and you lived with your spouse at any time during the year | $10,000 or more | zero |

single, head of household, or married filing separately and you did not live with your spouse at any time during the year | less than $138,000 | up to the limit* |

single, head of household, or married filing separately and you did not live with your spouse at any time during the year | $138,000 – $152,999 | a reduced amount |

single, head of household, or married filing separately and you did not live with your spouse at any time during the year | $153,000 or more | zero |

Source: IRS

*Limit refers to the annual IRA contribution limit. For 2023, it’s $6,500 or $7,500 if you’re 50 or older.

Aside from the income limits, Roth contributions will not lower your taxable income like other tax-advantaged accounts because contributions are made with after-tax dollars. As a high earner, you may need to think strategically about how you save and invest.

Leverage Your Employer-Sponsored Retirement Plan

Many companies offer traditional and Roth components to 401(k) or 403(b) plans. There are no income limits, but there are 401(k) contribution limits that combine traditional and Roth contributions.

401(k) Contribution Limits

Plan | 2023 Limit |

Individual 401(k) and 403(b) contributions, including Roth | $22,500 |

Individual + employer 401(k) and 403(b) contributions, including Roth | $66,000 |

Catch up contributions (aged 50 and older) | $7,500 |

You can also complete an in-plan conversion to a Roth 401(k) if you don’t want to contribute to that account ongoing. An in-plan conversion allows you to roll over pre-tax or after-tax 401(k) contributions into a Roth 401(k) that grows tax-free. There are three big rules to keep in mind:

- Your plan may not allow conversions.

- You’ll pay taxes on the conversion amount, including the original 401(k) contribution amount and any returns, in the tax year you convert. As you earn more, you can “time” your conversions in years most advantageous for you to minimize the tax bill.

- Roth accounts keep to the five-year rule, requiring the converted amount remain untouched for at least five years.

If your plan enables after-tax contributions, but not a Roth, you could take advantage of those after-tax contributions and immediately roll them over to a Roth IRA in what’s known as a mega backdoor conversion.

Would a Mega Backdoor Roth IRA Work for Me?

This strategy is a bit more complicated than an in-plan conversion but can be a beneficial way to build tax-free funds. Since there are quite a few moving parts, consulting with a financial advisor should be your next step.

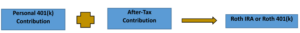

Let’s start with a backdoor Roth IRA conversion. The backdoor option exists because there are Roth IRA contribution limits ($6,500 or $7,500 if 50 or older) and income limits (see above). This “backdoor” allows you to avoid the income limitation.

Backdoor Roth IRA Conversions

![]()

Anyone can open an IRA account. There are no income or contribution limits, but there could be a hefty tax bill to pay if you convert pre-tax dollars or if the traditional IRA has any earnings.

Mega backdoor conversions earn their moniker by pushing the limits of your 401(k) contribution limits.

Mega Backdoor IRA Conversions

There are a number of conditions that need to be met.

- You’ve maxed out your personal, tax-deferred limit. In 2023, that’s $22,500.

- Your 401(k) plan administrator allows after-tax contributions. You can then save an additional $43,500. This also assumes your company doesn’t offer a match. If they do, deduct whatever that match is from your after-tax contribution limit.

- Your plan also allows in-plan conversions to either an in-plan Roth 401(k) or an outside Roth IRA account. With either option, the conversion needs to happen immediately to avoid paying taxes on any earnings.

The result? You don’t pay a tax bill for the conversion, and you get to grow a tax-free account by an extra $43,500 a year.

Roth Conversions After Retirement

When you’re close to retirement, the idea of converting large amounts of money to a Roth is either really expensive or won’t build your tax-free account fast enough. It may make sense to delay Roth conversions—in this case, a simple conversion from a traditional IRA to a Roth IRA—until after you retire.

Why wait until retirement? You typically want to complete Roth conversions when you are in a lower tax bracket. For some, that is likely during retirement before you start collecting a pension, Social Security, annuity income, required minimum distributions (RMDs), etc. This allows you to convert and ultimately pay taxes at a lower rate.

One of our clients built a retirement conversion plan that allowed him to convert his entire 401(k) and lump sum pension over six years. He doesn’t pay any taxes in retirement, his Social Security benefits are tax-free, and so are his dividends, capital gains and interest!

Convert with Caution

Even after retirement, Roth conversions are subject to the 5-year rule. You’ll also need to keep other taxes and premiums in mind for high incomes, like Social Security benefits and Medicare IRMAA.

HSA: The Other After-Tax Account

One of the main benefits of Roth accounts is tax-free income. Health savings accounts (HSAs) are another type of account that can generate tax-free income.

Funds from this account can only be used on approved medical expenses but building up this account can help you pay for costly medical care in retirement.

There you have it. Three Roth investment strategies (and a bonus after-tax option) to help you build up tax-free income during retirement. If you need help navigating your options—especially the mega backdoor Roth conversion—schedule a free consultation with a Metanoia Financial advisor and build a plan to reduce your tax obligation.