Managing your own investments is a significant undertaking. Even when your portfolio is small, keeping it balanced and diversified can feel like a full-time job. Plus, as your assets grow and you accumulate wealth, investment decisions become more complex and present greater risk.

When your net worth reaches the million dollar mark, properly managing your investments becomes an important task. Even a small hiccup can mean losing tens of thousands of dollars, so you want to make sure everything is done right. That’s why most high net worth individuals hire an investment manager.

What Does an Investment Manager Do?

An investment manager is a financial professional that handles your day-to-day investment decisions and strategic asset allocations. They structure your portfolio to help you reach your goals and manage everything that goes along with it, such as balancing accounts and diversifying investments.

Your investment manager will also devise a strategy for your portfolio, which will inform when to acquire or dispose of holdings and how to balance your assets. They can advise you on when is the best time to sell certain assets or to stand firm in your investment. In short, they take over the hassle of worrying about and making investment decisions so you can spend more time focused on what’s important to you.

When to Hire an Investment Manager?

Anyone with investments outside of their employer’s retirement account should consider working with an investment manager. No matter how small your portfolio, allowing a professional to manage your investments is the best way to get favorable results.

Aside from this, there are a few specific situations where it helps to have an investment manager:

- When you’re nearing retirement, having an investment manager can make the transition much smoother and easier for you. Transitioning out of your career is a much different process than saving up for retirement. Your investment manager can make sure you have enough money to comfortably sustain yourself through retirement and help you make strategic withdrawals from your account.

- As mentioned in the introduction, once your net worth surpasses $1 million it’s time to hire an investment manager. Managing large sums on your own can come with some hefty costs if you make a mistake. Working with an investment manager keeps you from making expensive errors and helps you continue growing your wealth.

- If you’re ready to spend more time focusing on your job or family instead of managing your investments, then it’s time to hire a professional. By outsourcing your portfolio management, you free yourself to enjoy more aspects of your life without worrying about how your investments are performing.

Overall, it’s time to hire an investment manager when you’re ready to pass the burden of portfolio management to someone else. For some people, this will be as soon as they have a few different retirement accounts. For others, it might be when they hit a net worth goal. Investment managers can help individuals go forward from wherever they are now.

How to Find the Right Investment Manager

Finding an investment advisor you trust is a process. There are a few key areas you should discuss before hiring someone to make sure they’ll be a good fit for you.

Investment Philosophy

First and foremost, you want to understand the manager’s investment philosophy. How they choose investment tactics will determine how the build and manage your portfolio. For example, some managers might take an aggressive approach to investing while others favor a more conservative technique. Make sure your investment manager’s philosophy aligns with your own and that you’re comfortable with them managing your portfolio that way.

Experience

Ideally, your investment manager shouldn’t be new to the field. You want someone with plenty of experience managing portfolios and helping clients like yourself. Finding someone who’s familiar with situations similar to yours and who knows how to successfully manage your investments is key. This especially includes how much money you need them to manage. If you have millions of dollars in investments, you need an advisor who regularly works with accounts of equal size.

Credentials

You can also check if they have any extra credentials. There are many different organizations and agencies that offer certifications in the finance industry — Chartered Financial Analyst®, CERTIFIED FINANCIAL PLANNER™, and Certified Kingdom Advisor® to name a few. Your investment manager’s certifications are likely to show what areas of investing they’re most interested or skilled in.

Values

Values-based investing is becoming more popular as people continue to choose investments that reflect their personal values. If you’re interested in pursuing this type of investment strategy, then you need to make sure your investment manager shares your beliefs and has options to structure your portfolio accordingly.

4 Tips for Wise Investing

It’s easy to get overwhelmed with the multitude of financial advice out there. But if you follow any suggestions, let it be these four tips.

1.) Understand Your Strategy

Make sure you understand the strategy your investment manager is using for your portfolio. Even if you aren’t a finance expert, have them explain it in a way that makes sense to you. When you know what type of investments you’re in and why, it helps you feel confident even in a down market so you stick with the plan and avoid making decisions based on fear.

2.) Avoid Financial Media

Financial media is always going to paint the worst-case scenario. It’s designed to make you scared, so it’s important you don’t buy into their catastrophic reports. Instead, try to avoid it as much as possible. Trust that your manager knows the market well enough to protect your assets and that your investments can stand the test of any situation. If you are concerned about something, call your manager and talk it through with them.

3.) Don’t Overmanage

Some investors react to every little change in the market, which leads to constantly buying, selling, and trading their investments. Or they’ll try to outcast the market by making investments based on what they think will happen in the future. The problem here is that you can’t make any gains if you’re constantly moving around your assets and you can’t know exactly how the market will react to changing circumstances.

Try to avoid day trading and overly active portfolios in favor of stable long-term investments. When you choose investments that can stand the test of any geopolitical or economical situation (and most can), then you don’t have to worry about every little change in the market. You can let your manager do the work for you to keep your portfolio balanced without making frequent major changes.

4.) Concentrate On What You Can Control

Most of your investment performance is going to be dictated by investor behavior, not the underlying investments. So instead of worrying about how your investments perform, which is out of your control, focus on how you behave when the market changes, which is in your control.

Understand and trust the strategy your investment manager has in place, avoid being frightened by financial media, and don’t start trading assets out of fear. Keep calm and stick to the plan no matter what the market shows and you’ll have successful investments.

Terms to Know

The financial industry is full of unfamiliar terms and complex topics, and if you aren’t a financial professional, you might feel a little turned around when someone starts talking about investments. These key terms can help you understand what your investment manager is recommending and why.

- Asset allocation: the mix of stocks, bonds, and cash that’s in your portfolio.

- Rebalancing: bringing your portfolio back to its strategic asset allocation. This could mean buying or selling small amounts of your assets to bring accounts back into balance and moving toward your goals.

- Diversification: investing in more than one type of asset and company. Diversifying your portfolio helps manage risk and protect your investments from the natural volatility of the market.

- Discretion: the level of control your investment manager has over your accounts. Total discretion means they can make trades and decisions regarding your portfolio on your behalf. Little discretion would mean they need to call you before making any decisions.

- Mutual funds: a professionally managed investment that pools money from multiple investors to create a diversified portfolio.

- Individual stocks: a share or stock in a single company. These investments can be risky and susceptible to market changes, so they are generally not advised as wise investments.

- Separately managed accounts (SMA): similar to mutual funds, these are professionally managed portfolios of individual stocks or bonds. This can be a little riskier than mutual funds but does have some tax benefits for non-retirement accounts.

Benefits of a Diversified Portfolio

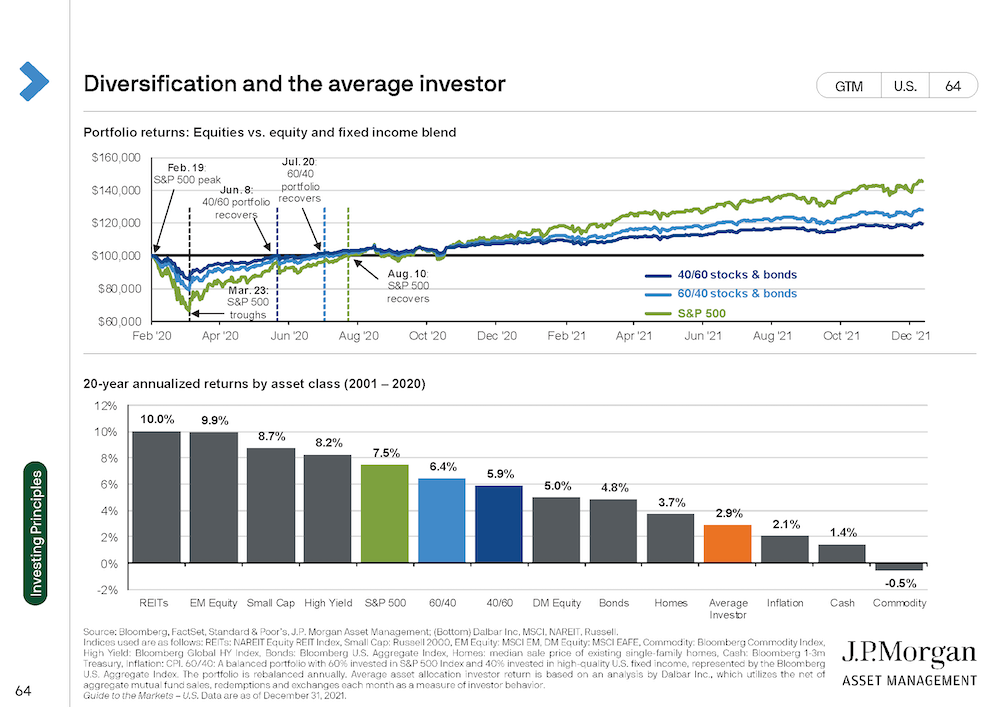

Above is research from J.P. Morgan’s most recent Guide to the Markets. It shows investor performance based on their portfolio diversification. You can see how individuals with the most diversified accounts (those invested in the S&P 500) were seeing the greatest returns on their investments at year end. Other investments were also on an upward trend, but not quite matching the most diversified investors.

This research shows two things:

- The market will always recover. During 2020, investments hit significant low points, but those investors who didn’t panic and stuck with their investment strategy were seeing returns by year end.

- Diversification pays off in the long run. Individuals with more diversified portfolios saw greater returns over time than those more concentrated on a single type of investment.

Start Investing for Your Future

If you’re ready to turn your attention from investments to your career or family, then it’s time to hire an investment manager. Finding a professional you know and trust will give you the peace of mind that your money is in good hands. At Metanoia Financial, we create personalized investment strategies for our clients that help them reach their long-term financial goals. Book a consultation with us today to see how we can help you invest for your future.