Introduction

For some people, investing feels like a guessing game. They try to pick the right stocks and funds, they do their best to time the market, but it all feels so… risky. There’s always the chance a stock could tank or the market itself could crash. And so, many people watch the stock market, biting their fingernails as funds spike and dip like waves on the ocean. If you’re like most people, you wish investing was less stressful.

Ready for some good news?

While investing will never be entirely risk-free, there are things you can do to protect yourself and your money. In this article, we’ll explain why investing is worthwhile and we’ll share how to minimize risk with your investments.

Is Investing Worth the Risk?

If investing is so risky, why should people do it?

Mainly, because the reward is worth the risk. Investing is the best way to build long-term wealth.

Investing puts your money to work for you and when done over time, can yield great returns. (Try calculating projected returns with this free tool.) Such returns are important when it comes to retirement. In your later years, you won’t earn a regular paycheck. But if you’ve invested wisely over your working life, you’ll have accumulated assets that will carry you through your golden years.

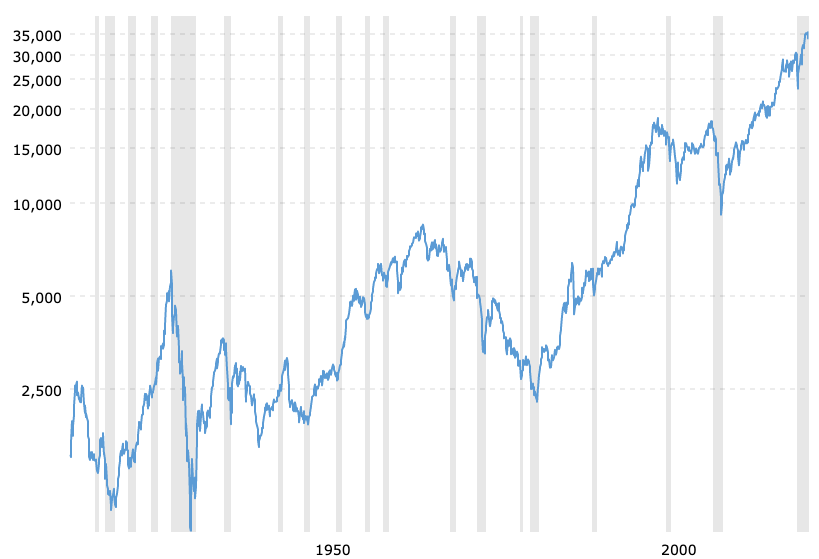

Now, it is true that positive returns are not guaranteed. The market has dipped and crashed at a few notable times in history, such as the Great Depression of the 1930s, the recession of 2009 and, most recently, the COVID-19 dip of last year. However, even with these crashes factored in, the stock market has grown by an average of 10% per year over the last century. This past performance is the most reliable information you can use to predict future results.

While there is certain to be short-term upticks and downswings, long-term investing could actually be considered quite safe.

In fact, investing can actually protect you from risk.

When most people consider risk with investing, they’re thinking about principal risk. They fear they’ll lose money on their investments if the market dips. But there’s another kind of risk that investing actually protects you from: the risk of inflation. Because of inflation, your money won’t be worth as much someday as it is today. If your assets sit in a savings account, your purchasing power is slowly eroding — historically 3% a year.

But if you invest those same assets, you won’t just counterbalance the effects of inflation, you’ll likely enjoy a net gain (10% stock market return – 3% inflation = 7% gain).

How to Minimize Risk with Your Investments

Hopefully, this information reassures you that investing isn’t as risky as you feared. But it’s still important to invest wisely. After all, this is your hard-earned money and how you invest greatly impacts your results. Here’s how to minimize risk with your investments.

1. Hire a Professional Advisor

The biggest risk to your portfolio is… you.

When investors see volatility in the market, they panic and sell their investments. And operating out of emotion, they put their returns in jeopardy.

Take this past year for example. Investors panicked and sold off their assets in March when COVID-19 forced the nation into lockdown. But what those investors didn’t know is that the market would rebound quickly and finish the year on a record high. Those investors lost out on big returns and many regret selling in the first place.

It’s easier to judge panicked investors from a distance, but it’s nearly impossible to be unemotional when it comes to your own money. This is the greatest value of hiring a financial advisor.

Financial advisors can be empathetic, yet objective. They’re able to step back and see the big picture, keeping you from making knee-jerk and risky decisions. With a trained professional holding steady at the helm, you’ll be ready for the volatile days and big decisions points.

2. Get a Plan Down in Writing

Once you have a financial advisor on your team, ask them to sit down and create a plan with you.

Investing is risky when it’s done reactively. It is much safer to sit down ahead of time (long before emotions take over) and come up with a game plan. Get specific about rules: when do you want to rebalance (we recommend rebalancing every 366 days), how will you change your goals as you near retirement, when does it make sense to sell?

These guidelines will create peace of mind. You’ll know you’re on track and will be able to make the right moves, no matter what anxieties are tempting your fight or flight response.

Remember, the longer you invest, the lower your risk. So make sure your plan is a long-term strategy.

3. Diversify Your Investments

Diversify, diversify, diversify. This is the number one rule of investing. The more diverse your assets, the lower your risk. If you invest across market cap, region and sector, one bad investment will never be able to wipe you out. One asset or industry may dip, but others in your portfolio will rise and you’ll be spared a net loss.

Diversify Across Asset Class

Stocks aren’t the only way to invest. There are also bonds, cash, real estate, commodities and currencies.

Each asset class will perform largely independent of the others. Stocks (or equities) are more risky while bonds are relatively safe (but have lower returns). A diversified portfolio will take advantage of this variety so that the impact of a dip in one asset will be minimized by a gain in another asset.

Diversify Across Market Cap

Market capitalization is the market value of a company. Corporations like Apple or Berkshire Hathaway have a value greater than $10 billion and are called large-cap. Because these companies are so big, they generally have lower risk and lower reward. They won’t suddenly crash, but they won’t jump through the roof either.

On the opposite end are small-cap companies. These companies have smaller market values (generally between $300 million and $2 billion). Because they’re smaller, these stocks offer more room for growth, but are more volatile and risky. They may succeed dramatically, or they may lose money just as spectacularly.

In the middle are mid-cap companies. These companies are more established than small-cap companies, but aren’t as big as large-cap alternatives. (Generally they are valued between $2 and $10 billion).

To minimize investment risk, a diverse portfolio will have companies at each level — offering the potential reward of small-cap with the relative safety of large-cap and everything in between.

Diversify Across Sector and Region

A diverse portfolio will also account for sector and region.

Investors will choose funds from various sectors (large segments of the economy similar to industries). They may, for example, select funds in the technology, healthcare, financial and energy sectors. Because these sectors are so independent of one another, a threat to one will not compromise all of them.

And finally, a diverse portfolio will consider region. This is where a company is located in the world. An investor may select funds from places across the US or the world, ensuring that should one region experience challenges, their entire portfolio will not be at risk.

Minimal Risk, Maximum Gain

If you really want to know how to minimize risk with your investments, schedule a call with Metanoia Financial.

As financial advisors, we’ll help you master the emotional and financial side of investing. Together we’ll come up with a written plan and a strategic asset allocation that will help you make the most of your investments.